Source: https://theprint.in/economy/lic-has-lost-more-than-rs-20000-crore-in-just-5-psu-stocks-modi-govt-made-it-buy-in-2-yrs/295765/

LIC has lost more than Rs 20,000 crore in just 5 PSU stocks Modi govt made it buy in 2 yrs

India’s largest life insurer LIC has assets of over Rs 31 lakh crore. But value of its investments in firms like New India Assurance, HAL & IDBI Bank has halved.

New Delhi: The Life Insurance Corporation of India has often ended up being the lender of last resort to the government.

But some high-profile and large investments made by LIC in the stocks of state-run companies in recent years have eroded in value, even though stock markets overall have grown during this period, an analysis by ThePrint has found.

LIC’s investment in initial public offerings (IPOs) of state-run firms or in share sales of listed PSUs, some accounting for around 50 per cent of the funds raised by the government through these issues, have seen their value halve, analysis of data from stock exchanges shows.

Besides, LIC increasing its stake in IDBI to 51 per cent has not proven to be a prudent buy as the bank has been bleeding due to heavy losses.

LIC, with total assets of more than Rs 31 lakh crore, is the country’s largest life insurer. It has not only bailed the government out through investments in state-owned firms and public sector banks, it has also lent a helping hand to fund-starved sectors like railways, road and power over the last few years.

Data released from the RBI shows that the share of public investments in LIC’s total investment increased to 85 per cent as of March 2019 from 79 per cent as of March 2014.

Also read: LIC put Rs 10.7 lakh cr in PSUs under Modi, almost same as investments in 6 decades to 2014

How each investment has fared

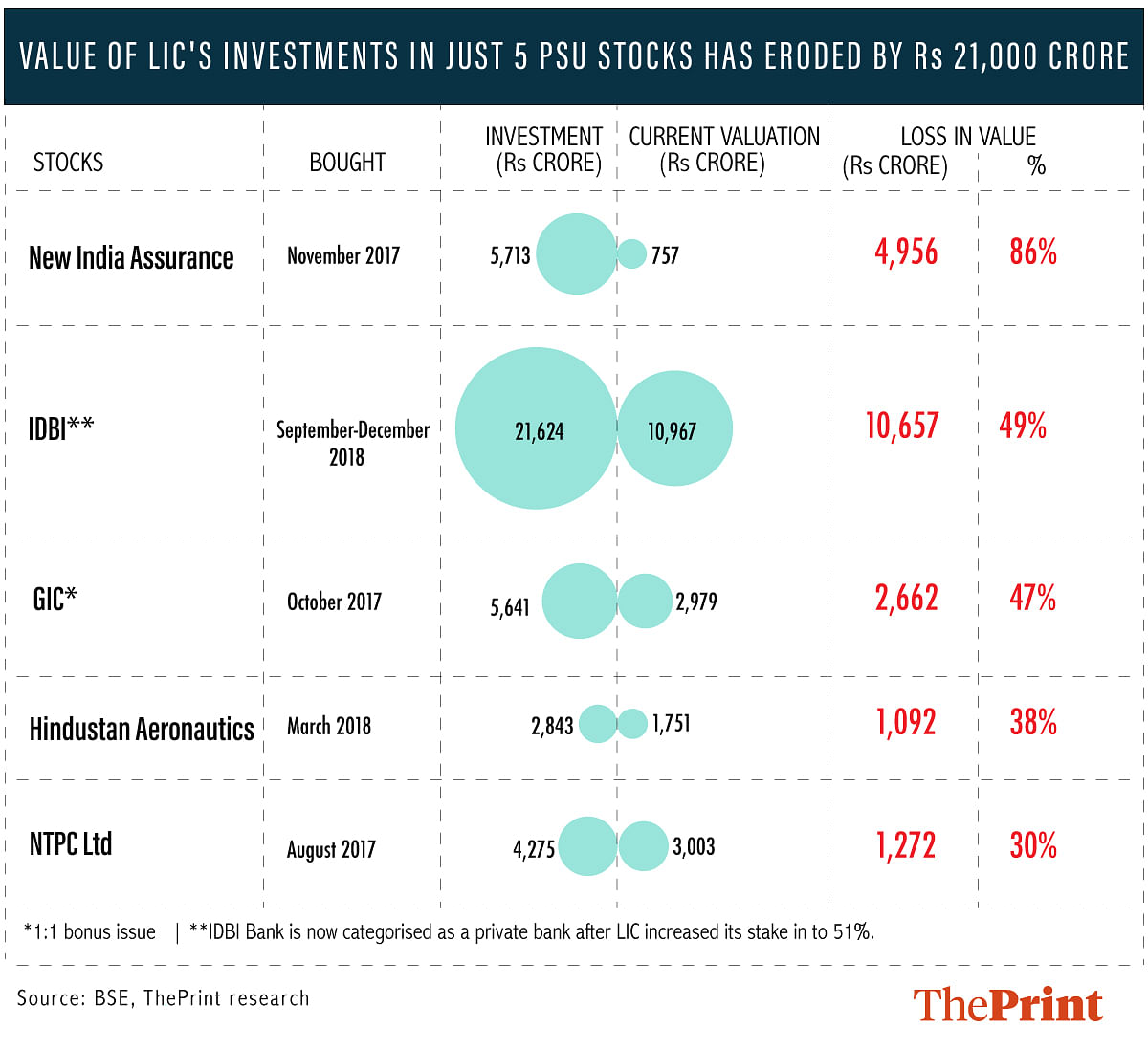

LIC picked up more than 50 per cent of shares offered in the IPOs of state-owned general insurer New India Assurance Company in November 2017. LIC made a total investment of Rs 5,713 crore at an issue price of Rs 800 at the time.

However, the value of LIC’s holdings had fallen to Rs 757 crore, down 86 per cent, after the share price fell to Rs 106.85 (23 September 2019).

It’s a similar story for another general insurer, General Insurance Corporation. LIC invested Rs 5,641 crore in GIC in October 2017, but the value of its investments has nearly halved to Rs 2,979 crore at present.

LIC’s investments in three other public-sector IPOs haven’t done well either. It invested Rs 2,843 crore in Hindustan Aeronautics Ltd in March 2018, but the value of its investments has fallen 38 per cent to Rs 1,751 crore. Its relatively smaller investments in MSTC (formerly Metal Scrap Trading Corporation) and Bharat Dynamics are also trading in the red.

Another example is the acquisition of the loss-making state-run IDBI Bank. LIC invested Rs 21,624 crore in the bank to increase its stake to 51 per cent from 8 per cent in September-December 2018. The value of its equity holdings is now Rs 10,967 crore, a fall of 47 per cent in less than a year, after the bank, now classified as a private sector lender, raked up losses amounting to Rs 8,718 crore in just two quarters.

LIC also picked up more than 40 per cent of the shares offered by the government in NTPC in August 2017. It invested around Rs 4,275 crore, but the value of that investment has come down by 30 per cent in the last two years to Rs 3,003 crore.

All in all, LIC has seen the value of its holdings erode by more than Rs 20,000 crore in just five major stocks in roughly two years.

Only two of LIC’s IPO investments in the last two years in state-owned firms are in the green. The IPO investments in Mishra Dhatu Nigam and GRSE (Garden Reach Shipbuilders & Engineers), totalling Rs 246 crore, have not made losses, but the gains are only Rs 50 crore.

LIC did not respond to an email seeking comments until the time of publishing this report.

Also read: Is Modi govt being reasonable or reckless in using LIC to back its ailing public sector?

No comments:

Post a Comment